Dhankesari Today Result 20.4.2024 Lottery Sambad 1PM, 6PM and 8PM: There you are at the awesome website which has been always told to be as Dhankesari lottery where this page and all the different posts made for the latest lottery sambad results and dear friends you always know that this detailed post is about the Dhankesrai today result morning, day and evening 1pm, 6pm and 8pm result and you know that its the day of another Friday 19th of April 2024 this lucky days sambad lottery today can it be always known to be as Dhankesari lottery and you know that in this post will be always updated in the best timing at 1:10pm, 6:10pm and 8:10pm.

| 20th April 2024 |

8PM Result

| Download PDF 8PM |

6PM Result

| Download PDF 6PM |

1PM Result

| Download PDF 1PM |

এখানে অনেক বাঙালি ভাই এঁরা আছেন কিনা lottery sambad result পাওয়ার জন্য লটারী সংবাদ রেজাল্ট বাংলায় সার্চ করেন গুগলে এ তাদের জন্য স্পেসিলয় অনেক আগে দেওয়ার চেষ্টা করি লত্ত্বেরই সংবাদ নিউজ বা রেজাল্ট টা। ধানকেশরী

Dhankesari Today Result lottery sambad result today is updated every day by its new Nagaland state lottery or it can be said as lottery sambad which are known as 11:55am morning, 4pm day and 8pm night, these lotteries is under the lotteries named as sikkim state lottery, west bengal state lottery and nagaland state lottery.

Yesterday 8PM Result

Stay connected with us Dhan Kesari gives Kolkata ff the fastest lottery sambad result everyday Dhankesari

so get ready and you know the Dhankesari lottery sambadt will be posted at 1:10pm morning, 6:10pm day and 8:10pm evening we also provide you the Lottery Sambad Live Draw and we also provide you the Lottery Sambad Old Result we also publish other popular lottery results popular as Sikkim State Lottery, West Bengal State Lottery, Nagaland State Lottery night, dear monthly 8pm, Khanapara Teer Result, Bodoland Lottery Result, Bhutan Lottery Result, Rajshree lottery Result and the last Lottery is Dear Laxmi 9pm, lottery sambad, Kolkata ff have a great day from Dhankesari.

Dhankesari Lottery Sambad Details:

| Dhankesari Lottery State | West Bengal, Nagaland |

| Dhankesari Lottery 1PM | Dear Tender Morning |

| Dhankesari Lottery Result 6PM | Dear Bangabhumi Ajay |

| Dhankesari Lottery Result 8PM | Dear Vulture Evening |

| Dhankesari Draw Time | 1PM, 6PM, 8PM |

| Category of Lottery | Dhankesari Lottery Sambad |

| Dhankesari 1st Prize | Rupees- 1 Crore |

Dhankesari lotteries result dhankesari

Many of the confused mans are searcging for this type of query they actully does not known about it specifacily and they search for Dhankesari today result dhankesari so dont be panich you will found us. Shark Tank India 2022 richest shark

Dhankesari old result

Dhankeshari old is about to tell you the yesterday or old result which are peoples are searcging to see the yesterday game results and want to match the lotteries to find the winning tickets which know as dhankesari lottery sambad

To watch the latest Web Stories on click on the stories section

- Gujrat VS Punjab

- Janhvi Kapoor Photos

- Bhuvan Bam New Web series ‘Taaza Khabar’

- Netherlands vs Poland

- New Apple iPhone-14 Upgrades Launch Date

- Who is the Richest Shark on Shark Tank India 2022?

Dhankesari Lottery Sambad Today

Dhan kesari lottery sambad today means today lottery result which are playing is at morning 11:55am, day 4pm and evening 8pm and if you search on google for this query then you will find our website to see those results.

- Lottery Sambad

- Nagaland State Lottery

- Sikkim state lottery

- West Bengal State Lottery

- Nagaland Lotteries

- Lottery Sambad Old Result

- Lottery Sambad Live Draw

Dhankesari लॉटरी (धनकेसरी)

बहुत सारे लोग है जो कि हिंदी भासी है और उनको हिंदी में सर्च करने बहुत ही पसंद है तो दोस्तो आप चिंता न करे आपके सुबिधा के लिए हमने धनकेसरी वेबसाइट को हिंदी के लिए वी ऑप्टिमाइज़ किये है ताकि अगर आप हिंदी में वी सर्च करे तो हमे ढूंढ पाए। Lottery sambad

Dhankesari lottery sambad supported states

धन केसरी 11:55 रिजल्ट

धन केसरी का जो सुबह का खेल है उसको आप धन केसरी मॉर्निंग रिजल्ट वी कह सकते है और उसको सभी हिन्दी भासी लोग धन केसरी मॉर्निंग से सीएच करते है और ये सुबह का रिजल्ट सबसे ज़्यादा मेहेततौरण हित है। BTS

धन केसरी 4pm रिजल्ट

दिन का खेल को धन केसरी 4pm रिजल्ट वी कहा जाता है, ओर दोस्तो ये खेल हमेसा सिक्किम स्टेट लाटरी, या फिर तो वेस्ट बंगाल स्टेट लाटरी के अंतर्गत होता है और ये रिजल्ट 4:10 मिनट पे पब्लिश होता है हमारे वेबसाइट मैं। जसको आपके धन केसरी टुडे 4pm वी बात सकते है।

धन केसरी 8pm रिजल्ट

धनकेसरी 8pm रिजल्ट दिन का सबसे आखरी रिजल्ट होता है और दोस्तो आपके जानकारी के लिए बात दु की इस टिकट को लोग सबसे ज़्यादा खरीदते है और सबसे ज़्यादा लोग इसके लिए गूगल में सर्च करते है। और दोस्तो हुम् सभी रिजल्ट के वीडियो यूट्यूब में पब्लिश करते है लाइव रिजल्ट, जो कि यह पर आपको लाइव देखने को मिलता है। जो कि धन केसरी video के नाम से परिचित हैধানকেশরী আজকের ফলাফলএখানে আমাদের অনেক বাঙালি ভাইয়েরা আছেন যারা কিনা বাংলায় ধন কেসরী রেজাল্ট সার্চ ককরে থাকেন তাদের কোন চিন্তা নেই কারণ আমরা ধানকেশরী ওয়েবসাইটে টিকে বাংলার জন্য ও অপটিমাইজ করেছি যদি আপনি গুগলে এ বাংলাতেও সার্চ করেন তাহলে এই ফলাফল গুলি পেয়ে যাবেন ও ডেইলি সিকিম স্টেট লটারি, ওয়েস্ট বেঙ্গল স্টেট লটারি এবং নাগাল্যান্ড স্টেট লটারি রেজাল্ট গুলি সহজেই দেখতে পাবেন।

Nagaland Dear 500 Saturday Weekly 8PM

About Dhankesari

Friends do you know that Dhan Kesari is fristly known as a Hindi Newspaper which are mostly popular for its news this compressive newspaper carries and circulated the Dhankesari Lottery Sambad prominently.Dhan keshari is founded back since 1992 from the house of Vyaper Sandesh Only Hindi Buisness Daily from Utter Pradesh since 1958 this is the newspaper which are daily higest circulated lottery daily in utter pradesh readibility in entire lottery trade. Kolkata FF

Dhankesari Live

Dhankesari daily start a live programme that know as lottery result live result which is live daily at 11:55am, 3:55pm and 7:55pm and you can watch the live result from our website directly and you can also watch the live results from the youtube, just you have to search it as dhankesari live result you will found the official channel. Dhankesari

Dhankesari morning result

Dhan kesari lottery today morning result which is the days 1st result and its very popular among its results the result will publish daiky at 12:10 pm but the live programme will start from 1pm thats why its named as dhankesari morning result. morning also know as sikkim state lottery result.

Dhankesari day result

This dhan kesari day result is also known as 4pm result which are publish at 4:10pm and the live result will start daily from 3:55pm so frinds daily get ready for its result. This dhankesari 4pm result also known as west bengal state lottery.

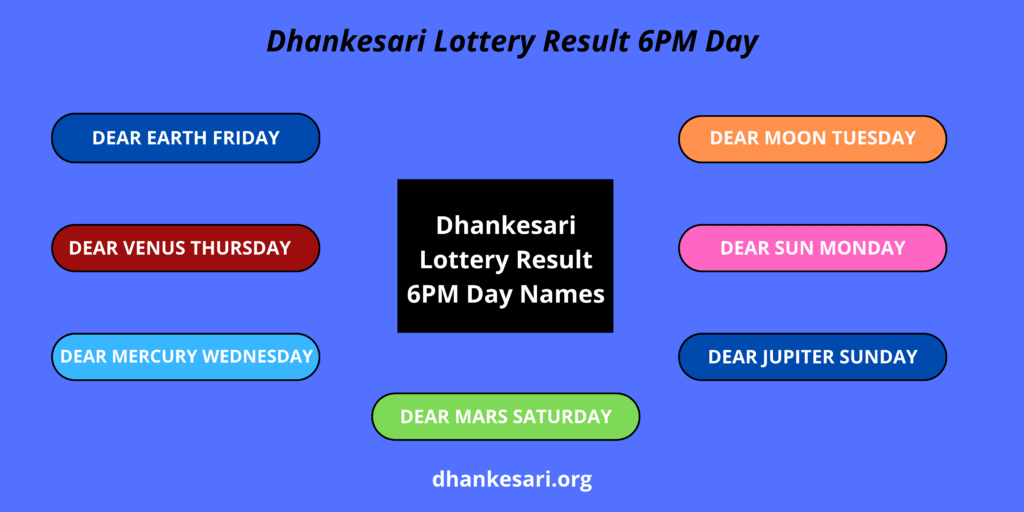

| Days | Draw Names |

| Sunday | DEAR EARTH FRIDAY |

| Thursday | DEAR VENUS THURSDAY |

| Wednesday | DEAR MERCURY WEDNESDAY |

| Tuesday | DEAR MOON TUESDAY |

| Monday | DEAR SUN MONDAY |

| Sunday | DEAR JUPITER SUNDAY |

| Sunday | DEAR MARS SATURDAY |

Dhankesari Night Result

Dhankesari Lottery Sambad evening result is the days last result which are publish on our website at 8:10pm and the live result will start from 7:55pm so friends its one of the most selling lotter sambad dhankesari which are mostly buying lottery of west bengal, peoples are search the lottery as nagaland state lottery 8pm. Lottery Sambad

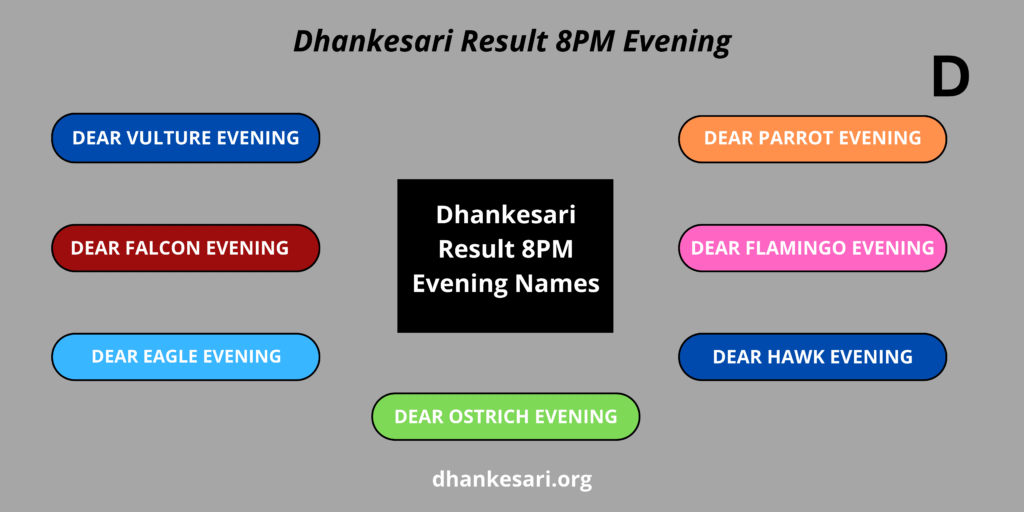

| Days | Draw Names |

| Sunday | DEAR VULTURE EVENING |

| Thursday | DEAR FALCON EVENING |

| Wednesday | DEAR EAGLE EVENING |

| Tuesday | DEAR PARROT EVENING |

| Monday | DEAR FLAMINGO EVENING |

| Sunday | DEAR HAWK EVENING |

| Sunday | DEAR OSTRICH EVENING |

What is Dhankesari?

Dhankesari is a website that provides information and updates on lottery results, particularly for the state of Nagaland in India. The website also provides information on other lotteries, such as those from other Indian states and other countries. It is not an official lottery website and is for informational purpose only. It is a third party website that provides news and updates about the lottery results.

Dhankesari Today Result

and this Lottery Sambad Dhankesari is one of the cheapest ticket so buy and get ready for todays result the ticket which costs you 6 rupee/ticket and we also publish other popular lottery results popular as West Bengal State Lottery, Sikkim State Lottery, Nagaland State Lottery night have a great day from Dhankesari Lottery Sambad.Lottery Sambad 2019 year is also one in every of the for most lucky one year for you. get your price tag and check out your luck to won the lottery. As you recognize there square measure several prizes and luck draw survived the daily. keep tuned to envision and transfer Lottery Sambad 2019 results up here. Lottery Sambadwe also publish other popular lottery results popular as West Bengal State Lottery, Sikkim State Lottery, Nagaland State Lottery night have a great day from Dhankesari Lottery Sambad.

- Dhankesari Lottery Sambad 11:55 AM Morning

- Dhankesari Lottery Sambad 4 PM Day

- Dhankesari Lottery Sambad 8 PM Evening

Dhankesari Lottery Sambad 1pm | Nagaland State Lottery Prize List

| 1st Prize | Rs- 26.26 Lakh |

| Cons. Prize | Rs- 1000/- |

| 2nd Prize | Rs- 9000/- |

| 4th Prize | Rs- 500/- |

| 4th Prize | Rs- 260/- |

| 5th Prize | Rs- 120/- |

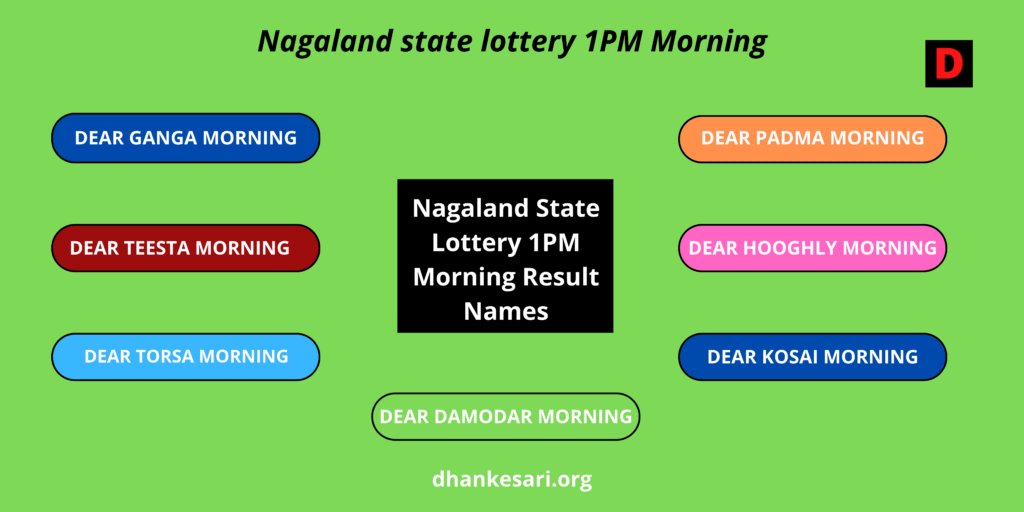

Dhankesari Today Result 1pm morning weekly games name

| Monday | Dear Loving Morning |

| Tuesday | Dear Sincere Morning |

| Wednesday | Dear Faithful Morning |

| Thursday | Dear Kind Morning |

| Sunday | Dear Tender Morning |

| Sunday | Dear Gentle Morning |

| Sunday | Dear Affectionate Morning |

Q&A About Dhankesari Today Result

Subscribe our Website Notification Dhankesari Lottery Sambad Dear and press the bell icon for instant updates, Have a great luck today. লটারি সংবাদ রেজাল্ট। 😀😀